What Provide You More Money Forex Or Crypto

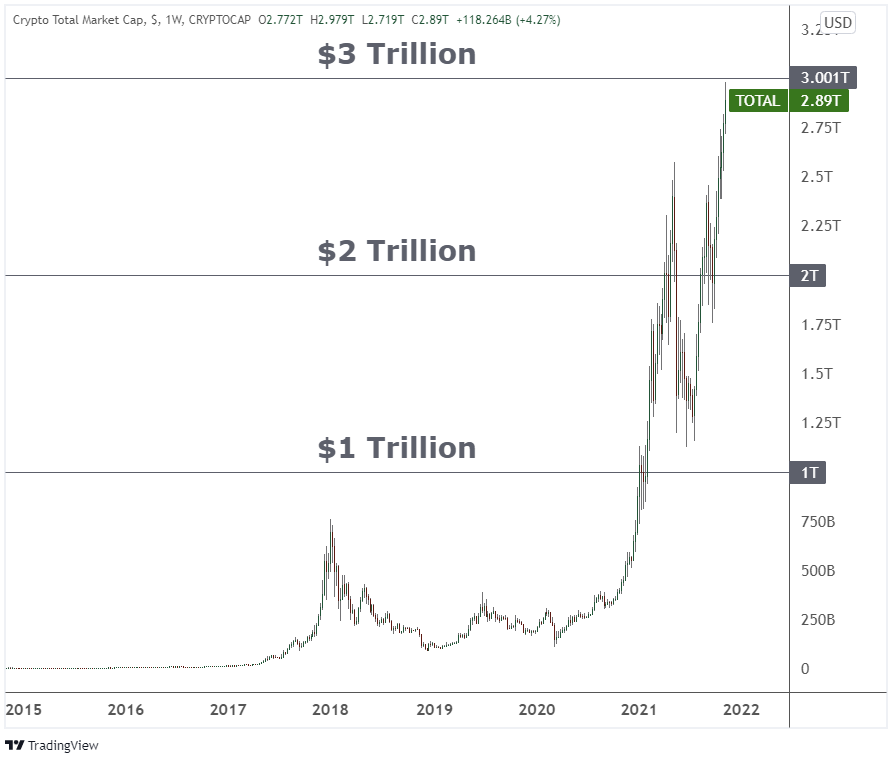

Over the past few years, trading in cryptocurrencies has grown, becoming more mainstream equally we experience a "digital" gold rush of new technology and innovation. This rise in digital currency investment has pushed the full market valuation of cryptos to above $3 trillion.

The speculative rise in blockchain technology and its many cryptocurrencies has caught the attention of traders, who are afraid of missing out on significant gains.

This is a huge difference from forex (FX) markets, where the commutation rates between currencies hardly move. The leverage that'southward applied to forex is what creates its appeal for traders.

In this commodity, we'll discuss the similarities and differences between forex and crypto trading.

The Landscape of Crypto and Forex Trading

Crypto and forex trading take both commonalities and differences. Crypto trading is the buying and selling of digital assets, such every bit cryptocurrencies, tokens and NFTs ( non-fungible tokens ). Forex trading means swapping one fiat currency for another in the hope the currency will ascension in value, which the trader tin then reconvert for profit.

The mechanics that drive the valuations of cryptocurrencies and fiat currencies are similar, such as supply and demand. Nevertheless, the specific forces behind the supply and demand are significantly different for crypto and forex.

For example, cryptocurrencies are run on blockchain applied science involving a distributed and decentralized ledger. Every bit a upshot, enormous investment is existence put into this new infrastructure, with demand for cryptocurrencies going through the roof.

Forex trading — essentially, pitting i economy confronting another, in the hope that the value of the currency you've bought volition increase — has been around for decades. The forces behind supply and demand in forex are large, and any meaning imbalances can have a tremendous affect on the world economy.

When conducting technical analysis, the bones mechanisms used to analyze cost charts are the same betwixt crypto and forex trading. However, one huge difference stands out: the volatility of crypto markets is significantly higher than that of FX.

Image source: TradingView

Image source: TradingView

In the image above, the boilerplate true range (ATR) indicator has been practical to the weekly endmost prices for the largest cryptocurrency (Bitcoin) and the most actively traded forex pair (EUR/USD). The ATR has been standardized to decide a volatility percent, which reflects how far the asset might motility in any given week.

The chart higher up indicates that the forex's ATR is between 1.1% and 1.iv%, whereas that of Bitcoin ranges between 7.5% and 25%.

Market Capitalization

But equally cryptocurrencies help fuel various blockchain projects, forex is the fuel for the world's economies. One of the benefits that Satoshi Nakamoto created when developing Bitcoin was a transparent ledger of ownership for the cryptocurrency. Equally a result, we tin easily make up one's mind the size of the cryptocurrency marketplace.

The total market place capitalization for crypto is nearly $3 trillion. It took 12 years to generate the offset $one trillion combined valuations, then another 11 months to add together the next $ii trillion. The total value of the crypto market is speedily accelerating higher.

It's more difficult, on the other hand, to determine forex's value. Economists can gauge the total value of the worldwide economy, which in 2017 was estimated to be $80 trillion.

Every three years, the Bank for International Settlements (BIS) estimates the world'south trading volume in foreign substitution. The near recent written report came out in September 2019, when BIS found that forex traded $six.half-dozen trillion per twenty-four hour period, up from $5.1 trillion three years before.

Due to the decentralized nature of crypto, information technology's hard to arrive at a conclusive effigy for trading volumes, only estimates range between $100 billion–$500 billion per mean solar day.

Forex trading is well-established, and the systems and mechanisms for trading it has been in place for some time. Even though Bitcoin has been around for 13 years, acquiring Bitcoin has only become easy to do within the by several years.

Market place Participants

In the early on days of Bitcoin, there were miners, retail clients and some small centralized exchanges. These exchanges have now expanded to offer hundreds of cryptocurrencies.

In addition, in crypto'south early days, the ability to agree crypto custody on behalf of another party hadn't still been worked out. It wasn't until MicroStrategy (MSTR) announced its first purchase of Bitcoin in August 2020 that the door opened to corporations who wanted to make cryptocurrencies a part of their treasury plans.

This immune a larger puddle of crypto "whales" to enter into the motion-picture show. Bitcoin and Ethereum are the two primary cryptocurrencies which institutions are gobbling up.

With forex trading, banks are swapping currencies all the time, and accept done and then for decades as multinational corporations need to brand payroll in other countries. Banks deal with each other in "yards," which are one billion units of currency. Within the by 20 years, smaller forex dealers have figured out the engineering science to allow them to purchase and sell currencies while netting off the exposure to bigger banks.

As y'all can run across, one primary departure between the evolution of crypto and forex trading is that crypto started off with the little retail trader in heed, while forex trading was reserved for large banks. Eventually, larger institutions were included within crypto, while the "little guy" was somewhen given access to forex trading.

Trading Pairs

When trading a market, you're always swapping one thing for something else. For example, if yous're going to buy Tesla stock, you're likely exchanging your United states dollars for TSLA.

Forex traders have a very adept understanding of the swap, which is why their currencies are quoted in pairs. As an case, there are seven main currencies which traders speculate in. When you place those currencies in a matrix, you get 21 pairs (see bolded pairs).

| USD | EUR | GBP | JPY | CAD | AUD | NZD | |

| USD | EURUSD | GBPUSD | USDJPY | USDCAD | AUDUSD | NZDUSD | |

| EUR | EURUSD | EURGBP | EURJPY | EURCAD | EURAUD | EURNZD | |

| GBP | GBPUSD | EURGBP | GBPJPY | GBPCAD | GBPAUD | GBPNZD | |

| JPY | USDJPY | EURJPY | GBPJPY | CADJPY | AUDJPY | NZDJPY | |

| CAD | USDCAD | EURCAD | GBPCAD | CADJPY | AUDCAD | NZDCAD | |

| AUD | AUDUSD | EURAUD | GBPAUD | AUDJPY | AUDCAD | AUDNZD | |

| NZD | NZDUSD | EURNZD | GBPNZD | NZDJPY | NZDCAD | AUDNZD |

With virtually FX brokers, you lot tin can log in and find a quote for an exchange rate on any of these pairs. You don't even have to accept European euros or Japanese yen in your account to brand a EUR/JPY trade. By trading EUR/JPY, you're speculating on the move of the commutation charge per unit for EUR against JPY.

Crypto is nonetheless within its early on adoption bend. Although y'all can easily create your own cross rate, most crypto pairs use Tether (USDT), Bitcoin (BTC), Ethereum (ETH), or the exchange'due south native coin as the quote currency.

On tiptop of that, there are over x,000 cryptos at present available. Information technology's only too cumbersome to create a swap from ii relatively pocket-size cryptos. Therefore, an intermediary like Bitcoin, Tether or Ethereum is used: for example, you first merchandise into Ethereum, then buy the coin you lot're interested in.

Tax Mechanisms

IRS rules inside the U.s.a. treat forex gains and losses differently from crypto gains and losses.

First of all, forex is considered as a Section 1256 contract of the IRS tax code. This means that 60% of the gains or losses are counted equally long-term capital gains or losses, and the remaining 40% are counted as short-term, regardless of how long you've held the trade open up.

Spot forex traders can opt to exist taxed according to Department 988, which treats the gains or losses as ordinary income. A profitable trader volition probable come across more than reward in choosing the Section 1256 contract route, while a trader taking losses may experience more do good going the Department 988 road.

Before beginning trading, forex traders must decide which route they programme to become, as they cannot change their election afterward.

With crypto, on the other manus, in that location is no selection in the affair. Crypto is treated every bit property, and it'southward taxed similarly to stocks. The taxation is figured when yous sell the crypto and depends on how long you've held the position open up. A trade that'due south been held for 365 days or less is considered a brusk-term gain or loss. This short-term proceeds or loss is payable at the same taxation rate as your ordinary income.

If, on the other mitt, the crypto has been held for 366 days or more, then information technology'southward considered a long-term gain or loss. Typically, y'all'll pay less revenue enhancement on a long-term gain than on a short-term gain because the rates are generally lower.

The big difference between forex and crypto when it comes to taxes is that forex traders have to cull ahead of time how they want their gains and losses treated, while all crypto merchandise is treated the same.

Profitability

It's widely known within the forex trading community that the majority of traders lose money. Depending on the quarter, typically between 25–35% of the traders produce at least $1 more than in their account through the course of that quarter. This ways that 65–75% of traders don't — and therefore lose money.

A big contributing gene in the traders' losses is leverage. Leverage is a fiscal tool that can magnify losses and gains. Therefore, when large amounts of leverage are used, the market just needs to move a little against the trader'southward position to trigger a margin call — which wipes out a meaning portion of their trading account. Generally speaking, less than 10× leverage allows traders plenty breathing room to withstand precipitous changes in pricing.

With the advent of high-speed computing and the decentralized nature of both forex and crypto, arbitrage opportunities tin exist betwixt ii unlike dealers or exchanges. In arbitrage, a trader will purchase at one venue so sell at another, realizing the difference between the prices at the two venues.

Liquidity

The smaller toll movements in forex trading let dealers to offer deeper levels of liquidity. This is part of the reason why forex trades about $6.6 trillion daily, while crypto trading is estimated at between $100 billion to $200 billion daily and as high equally $516 billion in May 2021.This places the liquidity within the forex market at 12 to 60 times greater than that in the crypto market.

Both markets are big. With more liquidity, it's easier to get into and out of big positions.

Volatility

Crypto trading is inherently more volatile than forex trading. As a event, a higher margin is generally required (the more volatile the production is). Therefore, you typically encounter higher leveraged amounts available in forex trading than in crypto trading.

Market Operations

Both forex and crypto merchandise effectually the clock to meet the needs of investors and traders across the globe. As a result, both types of exchanges have offices scattered around the globe to service local clients.

Operating Hours

Forex trades 24 hours per day, 5 days a week, from Monday morning in Wellington, New Zealand to Friday afternoon in New York City. Some forex brokers offer trading over the weekend, just normally, y'all're simply transacting against your broker in those situations.

Crypto, on the other hand, never sleeps. In addition to trading 24 hours per twenty-four hour period, crypto trades a full seven days per week. At any fourth dimension of whatever solar day, y'all can buy and sell crypto with your exchange.

Sign Upward to Claim up to $600 Bonus Rewards

Market Structure

Forex pricing is created through the interbank market. Brokers then fatten the spreads to generate their own pricing feeds.

The crypto market was created based on the amount of liquidity beingness offered past participants at each of the locations. Every bit a effect, the crypto exchange you're using to trade large amounts might non have plenty crypto to transact at the time you desire to purchase.

DEX vs. CEX

A DEX is a decentralized exchange, and a CEX is a centralized exchange. The main deviation betwixt the two is that with a DEX y'all have complete control over the private keys to your crypto, while a CEX maintains control over your funds.

The trading volume on DEXs is quite small compared to their CEX counterparts, merely it's been growing over fourth dimension. Currently, nearly $6 billion is traded each solar day on DEXs.

Is Forex Safer than Crypto from a Regulatory Perspective?

Forex trading may exist considered a niggling safer than crypto. Unlike forex, the crypto marketplace has no fundamental authority, and is highly volatile; hence, it's prone to wild market swings.

Additionally, the crypto market is less liquid and has lower trading volumes, making information technology more than difficult to go into and out of big trades.

For these reasons, forex traders are generally offered more leverage, allowing them to make larger trades.

Is Forex More Beginner-Friendly than Crypto Trading?

Market newbies need to become familiar with the lingo specific to that market, the risks they'll generally be exposed to, and the platforms from which to trade.

For beginning traders, both forex and crypto use terms that can be intimidating. Agreement those terms can take a little time. The risks are slightly different between forex and crypto. With forex, the risk of too much leverage is the main reason traders lose. Within crypto markets, the volatile conditions are generally what injure traders.

Due to the relative difficulty in the past of onboarding new customers, crypto exchanges have gotten improve at making their platforms user-friendly — once the trader understands the associated lingo.

Number of Available Instruments

Depending on the broker, forex and CFD brokers will take more trading instruments available equally they strive to be that one-stop shop for a trader'south needs. Crypto exchanges offer dozens of instruments besides, just not equally many as forex and CFD brokers.

KYC Procedures

After 9/11, "know your client" (KYC) laws were put into place to foreclose criminals and terrorists from integrating illegal funds into the globe'due south banking system.

In essence, KYC was instituted in order for traders to show that they are human (not a bot) and that the source of their account funds is legitimate and not laundered.

Entry Levels

Both forex and crypto dealers' websites contain beginner-friendly content to help new traders. Look for sections that appeal to beginning traders, or for websites' teaching pages.

Forex vs. Crypto Trading: Hedging The Risks

Depending on their exposure to certain markets, traders may want to hedge those risks past using futures, options or perpetual swaps. For example, a person who earns their income from a smaller money may desire to diversify their crypto exposure into some of the larger cap crypto, such as Bitcoin or Ethereum. Investors could besides hedge investment risks by staking their assets to earn interest or catechumen their avails into stablecoin that is pegged to the US currency. Another strategy that involves hedging crypto risks is to perform liquidity assessment past determining the market'southward integrity, transaction speed and market fluidity. That's to allow traders to have quick access to exchanging their assets for greenbacks with minimal exposure to price slippage.

For example, a forex trader may have an income earned in Mexican pesos, and wants to hedge that exposure if the peso loses value. Accordingly, they could convert some pesos into U.S. dollars, or consider ownership crypto.

Do You lot Have What It Takes to Trade Crypto or Forex?

In conclusion, forex and crypto are both volatile, and they're not for the faint of centre. Carefully consider the unique qualities and risks of each market to decide if yous're set up, as well every bit which one is ameliorate for you. Depending on your take chances appetite,

Source: https://learn.bybit.com/trading/forex-vs-crypto-trading/

Posted by: dorroughundfuld.blogspot.com

0 Response to "What Provide You More Money Forex Or Crypto"

Post a Comment